Optimize your accounting with FreshBooks: A comprehensive solution for small businesses

One of the best accounting platforms for small businesses, FreshBooks is a widely-used tool that simplifies invoicing, streamlines expense tracking, and enhances financial reporting. By making it easier to manage and categorize transactions, FreshBooks ensures that bookkeeping is precise and efficient.

Its comprehensive suite of financial tools is designed to meet the diverse accounting needs of businesses, making it easier for bookkeepers to manage client accounts, ensure proper categorization, and maintain up-to-date records.

Why bookkeepers and accountants prefer FreshBooks:

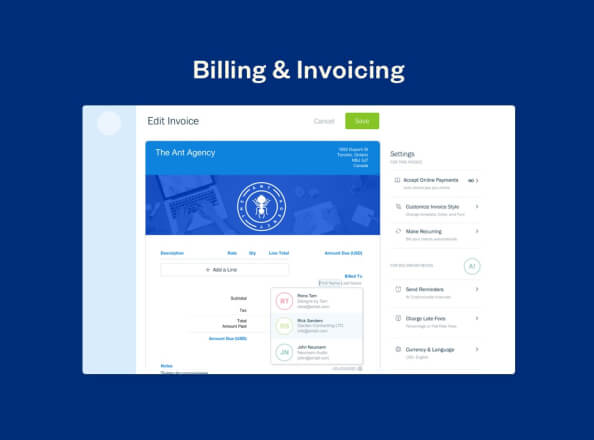

Simplified invoicing and payments

FreshBooks offers seamless invoicing solutions, including customizable templates, automated reminders, and online payment options. This allows businesses to get paid faster, reducing the hassle of manual follow-ups and ensuring accurate record-keeping. For bookkeepers, this means smoother reconciliation processes, fewer errors, and precise transaction records, all of which are vital for maintaining financial clarity.

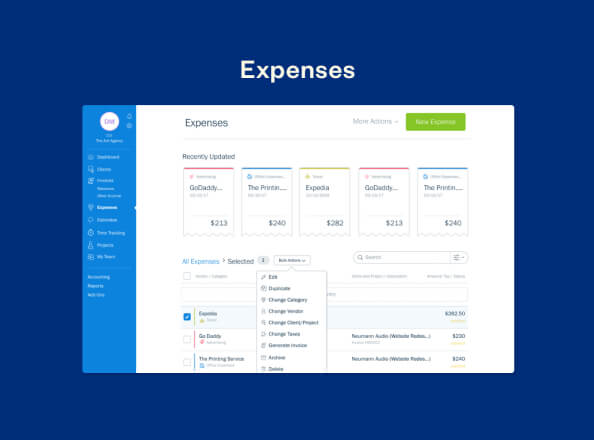

Easy expense tracking

With FreshBooks, tracking business expenses is effortless. Users can log, categorize, and even attach receipts directly to transactions, providing clear, up-to-date records. This minimizes manual errors, reduces paperwork, and simplifies reconciliation, making it easier for bookkeepers to maintain accurate financial records. Whether you’re logging travel expenses or tracking office supplies, FreshBooks makes sure everything is in order.

Detailed financial reports

FreshBooks allows you to create profit and loss statements, balance sheets, and expense summaries quickly and easily, giving you a clear overview of your business’s financial health. This enables bookkeepers to provide clients with accurate, insightful financial overviews, ensuring they can make informed business decisions. The platform’s comprehensive reporting tools also allow bookkeepers to identify trends, spot inconsistencies, and optimize financial strategies.

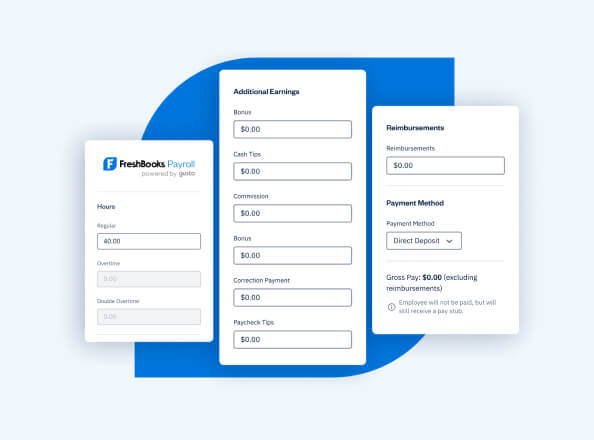

Automatic time tracking and billing

For businesses that bill by the hour, FreshBooks offers an integrated time tracking feature that connects directly with invoices. This eliminates the need for separate tools, streamlining the billing process and ensuring that clients are billed accurately for the time spent on projects. With FreshBooks, bookkeepers can be sure that all billable hours are accounted for, simplifying the invoicing process and enhancing client satisfaction.

Customizable financial solutions

With FreshBooks, businesses can tailor financial tools to meet their specific needs, from managing client accounts to generating comprehensive reports. This flexibility ensures accurate categorization and efficient record-keeping. For bookkeepers, this means having access to customizable features that make tracking and managing finances much easier, enabling them to provide more personalized services to their clients.

Multi-currency support

For businesses operating internationally, FreshBooks supports multiple currencies, making it easier to manage global transactions. This ensures accurate record-keeping and seamless accounting, even when dealing with clients across borders. Bookkeepers can handle exchange rate differences efficiently, ensuring that international transactions are categorized correctly, and financial records remain consistent.

Integration with popular tools

FreshBooks integrates smoothly with other popular business tools like PayPal, Stripe, and G Suite, providing a unified approach to managing various aspects of a business’s financial operations. These integrations help bookkeepers streamline workflows, automate data entry, and reduce the time spent on manual tasks, which enhances overall efficiency and productivity.

Why CoCountant chooses FreshBooks

At CoCountant, we choose FreshBooks for its reliability, flexibility, and seamless integration with our services. By incorporating FreshBooks into our bookkeeping and accounting services, we leverage its powerful features to ensure that all financial processes are managed accurately and efficiently.

From automatic invoicing to comprehensive financial reporting, FreshBooks allows us to maintain financial clarity, reduce errors, and streamline operations for our clients. This means that our bookkeepers can spend more time focusing on strategy and less time on tedious manual tasks.

If you’re looking for a partner to optimize your accounting operations—whether it’s for seamless invoicing, precise expense tracking, or detailed financial reporting—we can help.

Speak to us today to learn more about how CoCountant’s expert bookkeepers and accountants can streamline your business operations with FreshBooks.

Frequently asked questions

Why should I use FreshBooks for my small business?

FreshBooks simplifies accounting by offering easy-to-use tools for invoicing, expense tracking, and reporting. It’s especially beneficial for small businesses because it integrates easily, reduces manual work, and offers clear financial insights. With FreshBooks, managing finances becomes simpler, giving you more time to focus on growing your business.

How much does FreshBooks cost?

FreshBooks offers various pricing plans to fit different business needs. You can choose a plan based on the features you require, and there are no hidden fees. Additionally, they offer a free trial to help you get started, making it easy to explore all that FreshBooks has to offer without a long-term commitment.

Can FreshBooks manage invoicing for my clients?

Yes, FreshBooks is designed to simplify invoicing with customizable templates, automated reminders, and online payment options. This ensures businesses can get paid faster and more efficiently, enhancing cash flow and client satisfaction.

Is FreshBooks suitable for freelancers and small businesses?

Absolutely. FreshBooks is ideal for freelancers and small businesses that need to manage invoicing, expenses, and financial reports. It offers flexibility and ease of use, making accounting tasks less time-consuming. Freelancers can track billable hours, send invoices, and manage their business finances, all from one intuitive platform.

Does CoCountant provide support for FreshBooks users?

Yes, CoCountant offers comprehensive support for businesses using FreshBooks. From setup to ongoing management, our team of expert bookkeepers ensures that your financial processes run smoothly, allowing you to focus on what you do best—growing your business.

Can FreshBooks handle multi-currency transactions?

Yes, FreshBooks supports multiple currencies, which makes it easier for businesses to manage transactions across borders. Whether you’re invoicing clients overseas or managing expenses in different currencies, FreshBooks ensures that your financial records are accurate and up-to-date, helping you avoid the complexities of exchange rate management.

What types of payment methods does FreshBooks support?

With FreshBooks, you can accept various payment methods, including credit cards, ACH transfers, PayPal, and other popular payment gateways. This flexibility allows you to cater to a broader customer base, ensuring that clients have convenient ways to pay, which can improve cash flow and client satisfaction.

Is FreshBooks secure for managing my business finances?

Absolutely. FreshBooks uses industry-standard encryption and security protocols to protect your data. They comply with strict data privacy regulations, ensuring that your business and financial information is always safe and secure.