Transform expense reporting with Fyle: Comprehensive, real-time expense control and management

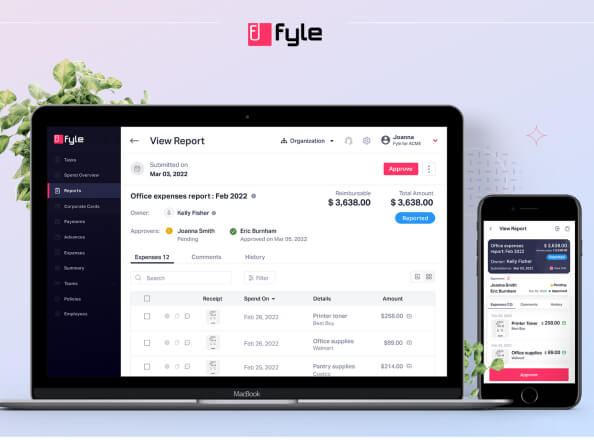

Fyle is a comprehensive expense management software for bookkeeping and accounting designed to simplify the process of tracking, managing, and reporting expenses.

By simplifying expense tracking and reporting, Fyle ensures that bookkeeping is precise and efficient, allowing bookkeepers to maintain up-to-date records and reduce the risk of errors.

Why bookkeepers and accountants prefer Fyle for expense management and reporting:

1. Simplified expense tracking

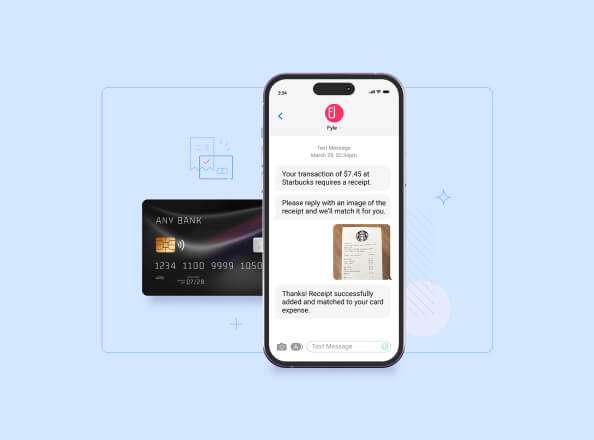

Fyle allows businesses to easily capture receipts and track expenses in real-time through a user-friendly mobile app and web platform. This simplicity ensures that all expenses are accurately recorded and categorized, which is crucial for bookkeepers to maintain accurate financial records and reduce the risk of missing or misclassifying expenses.

2. Automated expense reporting

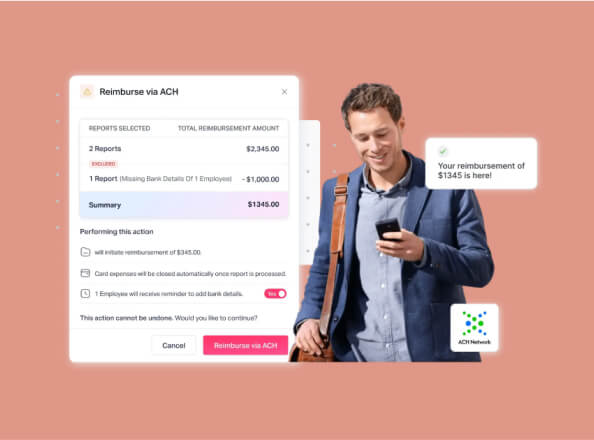

With Fyle, expense reporting is automated, allowing employees to submit expenses directly through the app, which are then automatically categorized and verified. This automation saves time for both employees and bookkeepers, reducing manual entry and minimizing errors in expense reports, ensuring that the books are always accurate and up-to-date.

3. Real-time expense policy enforcement

Fyle provides customizable expense policies that automatically flag violations in real-time. This feature helps ensure compliance with company policies, reducing the risk of unauthorized or non-compliant expenses. For bookkeepers, this means improved financial integrity and a streamlined review process, allowing them to focus on maintaining clean and compliant financial records.

4. Seamless integration with accounting software

Fyle integrates seamlessly with popular accounting software like QuickBooks, Xero, and NetSuite. This integration reduces manual data entry and ensures that expense data is synced with existing financial systems, allowing bookkeepers to maintain accurate, up-to-date records effortlessly. Learn more about our integration with QuickBooks and other accounting software.

5. Comprehensive analytics and insights

Fyle offers detailed analytics and reporting tools that provide insights into spending patterns. These insights help bookkeepers and accountants identify opportunities for cost savings and optimize expense management strategies, ultimately supporting more informed financial decisions and enhancing the overall quality of bookkeeping.

Why CoCountant chooses Fyle

At CoCountant, we integrate Fyle into our bookkeeping and accounting services because of its robust expense management capabilities. By using Fyle, we streamline expense tracking and reporting processes, ensuring compliance with company policies and maintaining the accuracy of financial records. This integration allows us to deliver comprehensive expense management support, freeing up small business owners to focus on growth while we handle the details.

If you’re looking for a partner to optimize your expense management—whether it’s for simplified expense tracking, automated reporting, or real-time policy enforcement—we can help.

Speak to us today to learn more about how our bookkeepers and accountants can support your financial operations with Fyle.

Frequently asked questions

Why should I use Fyle for my small business?

Fyle is an expense management platform that simplifies tracking, managing, and reporting expenses. It’s particularly beneficial for small businesses because it automates expense reporting, enforces policy compliance, and integrates with popular accounting software.

How much does Fyle charge for its expense management services?

Fyle offers various pricing plans based on the number of users and features required. There are no hidden fees, and businesses can choose a plan that fits their budget and expense management needs.

Can Fyle help with policy compliance?

Yes, Fyle provides customizable expense policies that automatically enforce compliance in real-time, flagging any violations and ensuring that all expenses are within company guidelines.

How does Fyle integrate with my existing accounting software?

Fyle integrates seamlessly with accounting software like QuickBooks, Xero, and NetSuite, allowing you to sync expense data directly into your financial systems, reducing manual data entry and ensuring accurate records.

Is Fyle secure for managing expense data?

Fyle uses advanced encryption and security measures to protect sensitive expense data, ensuring that all financial information is handled securely and in compliance with data protection regulations.

How quickly can I start using Fyle for expense management?

You can get started with Fyle immediately after signing up and completing a few onboarding steps, such as setting up expense policies and linking your accounting software. The platform is designed for quick setup and easy integration.

Does Fyle provide customer support for small businesses?

Yes, Fyle offers customer support through chat, email, and phone, along with extensive online resources to help small business owners manage their expenses effectively.