Streamline financial operations with PayPal: secure payment solutions for businesses

PayPal is a trusted payment platform that simplifies online transactions for businesses worldwide. With tools for invoicing, subscription management, and real-time payment tracking, PayPal empowers businesses to optimize cash flow and improve financial transparency.

PayPal integrates seamlessly with accounting software, e-commerce platforms, and CRMs, providing businesses with a unified system for managing payments. Known for its reliability and global reach, PayPal is ideal for businesses that need secure, scalable payment solutions.

Why bookkeepers and accountants prefer PayPal:

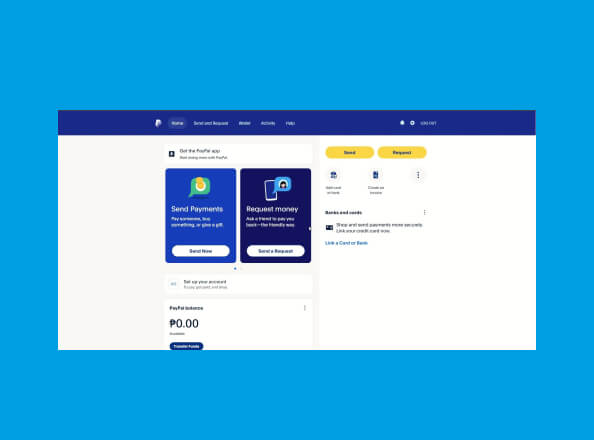

Effortless invoicing and payment tracking

PayPal simplifies invoicing with customizable templates, recurring payments, and real-time payment notifications. Bookkeepers value the platform’s ability to reduce errors and improve cash flow visibility.

Global payment support

With support for 25+ currencies and local payment methods, PayPal enables businesses to accept payments from customers worldwide. This feature helps bookkeepers manage multi-currency transactions and maintain accurate financial records.

Advanced fraud protection

PayPal’s built-in fraud detection tools ensure secure transactions, reducing the risk of chargebacks and fraud-related financial disputes. Bookkeepers appreciate the reliability of secure financial data.

Detailed financial reports

PayPal offers detailed reporting tools that provide insights into transaction histories, revenue trends, and customer behavior. These reports help bookkeepers deliver actionable data for strategic decision-making.

Seamless integration with accounting tools

PayPal integrates with leading accounting platforms like QuickBooks and Xero, automating transaction imports for easy reconciliation. This integration streamlines bookkeeping tasks and enhances financial accuracy.

Scalable for businesses of all sizes

From startups to enterprises, PayPal’s flexible solutions grow with businesses. Bookkeepers benefit from consistent workflows and reporting, regardless of business scale.

Why CoCountant chooses PayPal

At CoCountant, we integrate PayPal into our bookkeeping and accounting services to simplify and enhance payment processing for businesses. With its secure platform, automated tools, and global reach, PayPal helps us deliver accurate and efficient financial workflows tailored to our clients’ needs.

From managing invoices to tracking payments and handling multi-currency transactions, PayPal ensures seamless financial operations. By leveraging PayPal’s capabilities, we help businesses maintain precise financial records, improve cash flow management, and focus on growth while we handle the details.

Ready to simplify your payment processes?

Let CoCountant help you integrate PayPal into your financial workflows. Improve cash flow, gain actionable insights, and scale your business with confidence.

Frequently asked questions

Why should I use PayPal for my business?

PayPal is a secure, global payment platform that simplifies online transactions, invoicing, and payment tracking for businesses of all sizes.

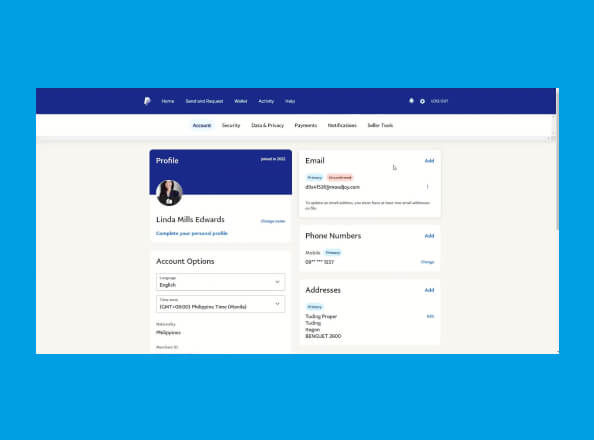

Does PayPal integrate with accounting software?

Yes, PayPal integrates with QuickBooks, Xero, and other accounting platforms, making it easy to import transaction data and streamline financial workflows.

What payment methods does PayPal support?

PayPal supports credit and debit cards, bank transfers, and local payment methods in 200+ markets worldwide.

Can PayPal handle multi-currency transactions?

Absolutely. PayPal supports over 25 currencies, making it an excellent solution for businesses operating internationally.

Is PayPal secure for payment processing?

Yes, PayPal offers advanced fraud detection, buyer and seller protection, and PCI DSS compliance, ensuring secure payment transactions.

Does CoCountant provide support for PayPal users?

Yes, CoCountant specializes in managing financial operations on PayPal’s platform. Our bookkeeping and accounting expertise ensures accurate records, streamlined workflows, and actionable financial insights.