Understanding retained earnings is essential for gauging your business’s financial health and driving growth. This blog details the retained earnings formula, calculation, and examples, showcasing success stories like MailChimp.

Don’t you wish your small business had a financial cushion that could help you weather tough times and seize growth opportunities?

That’s exactly what retained earnings can do for you.

We often hear about giants like Amazon using their substantial retained earnings to fund ventures[1] like Amazon Prime Video and Whole Foods Market. While retained earnings might sound like an accounting term reserved for big corporations like Amazon, they can make a significant difference for small businesses like yours, too.

Take the success story of MailChimp[2], for instance: Founded in 2001 by Ben Chestnut and Dan Kurzius, it began as a side project to their web development company.

Over time, they focused exclusively on Mailchimp, using retained earnings to fund its growth instead of relying on external investors, reinvesting their profits into developing new features and expanding their customer base.

This strategy allowed Mailchimp to grow sustainably and become a major player in the email marketing industry.

By understanding and effectively managing your retained earnings, you too can ensure your small business has the financial stability to grow and thrive. Whether you’re planning to expand, invest in new technology, or simply want a buffer for tough times, retained earnings can be a vital part of your business strategy.

Let’s go!

What are retained earnings?

Retained earnings are the profits left over after your business has paid out dividends to shareholders. Think of them as the profits set aside for future reinvestment, debt repayment, or savings for unexpected challenges.

These retained funds are crucial for assessing your financial health, whether you’re experiencing high profits or facing financial difficulties.

When your retained earnings are climbing, it’s a sign that your business is thriving. It means you’ve got a cushion for those rainy days and the confidence to take calculated risks. And as a small business owner, that’s exactly what you need to set your sights on big dreams without losing sleep over the financial bumps along the way.

Don’t think of retained earnings as the same as cash in your business bank account. While your cash balance fluctuates with your inflows and outflows, retained earnings are only impacted by your company’s net income or loss and the distributions paid out to shareholders.

In a nutshell, retained earnings are what’s left over from your profits after you’ve paid out dividends, and you decide to save some money for the future of your business.

Why are retained earnings important?

Now, why should you even bother with this number? Well, think of it as your company’s savings account since day one. It’s a handy tool for checking out your financial health – whether you’re riding high on profits or navigating stormy seas of losses and cash flow troubles.

When your retained earnings are climbing, it’s a sign that your business is thriving. It means you’ve got a cushion for those rainy days and the confidence to take calculated risks. And as a small business owner, that’s exactly what you need to set your sights on big dreams without losing sleep over the financial bumps along the way.

What do negative retained earnings mean?

Negative retained earnings indicate that your business has faced financial losses over time. This situation can signal that things have been tough financially and might require strategic adjustments to improve profitability.

A negative balance, also known as retained losses, suggests that you’ve paid out more in distributions to shareholders than you’ve earned in profits, or you’ve consistently experienced net losses.

What does it mean for a company to have high retained earnings?

There are two ways to look at high retained earnings, kind of like looking at a glass half full or half empty.

On one hand, it establishes your status as a profitable company by demonstrating success through the years.

But on the flip side, it might mean you’re not paying out much in dividends, which can affect shareholder satisfaction.

Ultimately, it depends on your business strategy and goals. High retained earnings provide a solid foundation for growth but should be balanced with ensuring adequate returns to shareholders.

The purpose of retained earnings

Retained earnings serve as a crucial link between your income statement and balance sheet. This means they help connect your company’s profitability (shown in the income statement) with the financial health and equity (shown in the balance sheet).

You can use these funds for multiple purposes.

- Reinvestment: Retained earnings are often used to reinvest in the business, such as purchasing new equipment, funding research and development, or expanding operations. This reinvestment aims to generate more earnings in the future.

- Debt repayment: Businesses can use retained earnings to pay down debt, reducing interest expenses and improving financial stability.

- Financial health indicator: Retained earnings are a crucial link between the income statement and the balance sheet, providing insight into the company’s profitability and financial health over time.

- Savings for future needs: Retained earnings act as a financial cushion for unforeseen expenses or economic downturns, ensuring the business can maintain operations during challenging times.

By retaining earnings, you ensure that profits are reinvested back into the business, contributing to long-term growth and stability.

However, if you determine that you can’t achieve a sufficient return on these retained earnings, you might choose to distribute them as dividends or conduct share buybacks to reward your shareholders. This approach balances reinvestment with providing returns to those who have invested in your company.

Where to find retained earnings in the balance sheet?

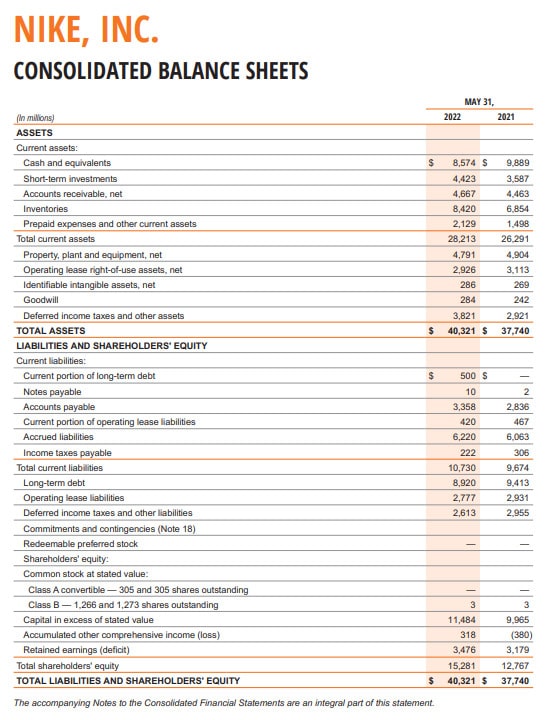

Retained earnings, also known as Member Capitol, can be found in the Equity section of your balance sheet under the heading Shareholder’s Equity.

Some companies also include retained earnings in their income statements.

Retained earnings formula

Here is the formula for retained earnings:

Beginning retained earnings + net income – dividends = retained earnings

Let’s understand what these three terms mean:

- Beginning Retained Earnings: It is the amount mentioned in the last accounting period, provided under the shareholder’s equity section of the balance sheet.

- Net income: It is the bottom line, also known as the profit or loss once you subtract the expenses

- Dividends: They are paid to the shareholders and can be both in cash and stocks

Calculation of retained earnings

Here’s a step-by-step guide to help you understand how to calculate retained earnings:

Step 1: Find your beginning retained earnings balance

Retained earnings are cumulative, meaning they accrue from one period to the next.

To start, you’ll need to know the retained earnings balance at the beginning of the period you’re calculating (typically the previous quarter or year).

This figure is listed under the shareholders’ equity section of your balance sheet from the prior period.

Step 2: Find your net income for the current period

Net income, also known as profit, is the total revenue left after subtracting business expenses.

This figure is found on your income statement (profit and loss statement).

If your expenses exceed your revenue, you’ll have a net loss.

Step 3: Find dividends paid to shareholders during the period

If your business pays dividends to shareholders, subtract the total amount paid out during the period.

Dividends can be in the form of cash or stock.

If no dividends are paid, use $0 for this part of the formula.

Example calculation of retained earnings

Let’s go through some examples together to help you understand how to calculate retained earnings, shall we?

Example #1:

Let’s say you start a small business with no retained earnings. In your first year, you make a profit of $250,000 and don’t pay any dividends. At the end of the year, your retained earnings would be $250,000.

Example #2:

Moving on to the second year, you make a net income of $400,000. Last year, your retained earnings were $250,000, and you paid out $100,000 in dividends.

To find this year’s retained earnings, use this formula: previous retained earnings + net income – dividends.

So, it’s $250,000 + $400,000 – $100,000, giving you $550,000 as your retained earnings.

Example #3:

Now, let’s look at the third year. This time, your company faces a loss. You started the year with $550,000 in retained earnings. Unfortunately, you ended up with a net loss of $250,000, but you didn’t pay any dividends.

Using the same formula, it’s $550,000 – $250,000 – $0, which equals $300,000. So, your company’s retained earnings for the third year are $300,000. Though they’re still positive, they’re lower because of the loss your company faced this year.

Retained earnings vs. revenue vs. profit

People often mix up revenue and retained earnings, thinking they’re the same. But they’re actually quite different.

Revenue

This is the total money your business makes from selling goods or services.

Example: Imagine you sell tacos at a festival. If you sell 55 tacos each day for three days, each priced at $5, your total revenue is $825.

Profit

It’s what’s left after you subtract the costs and taxes from your revenue.

Example: Using the taco festival again, if each taco costs you $2 to make, your profit per taco is $3. So, over the three days, your total profit would be $495.

Retained Earnings

This is the money you’ve saved up since the start of your business.

Example: Let’s say you’ve been selling tacos at the festival for five years. Your retained earnings would be the total profit from all those years. You could use this money to expand your business, like adding a lemonade stand or new sauce options.

How dividends impact retained earnings

There are two types of dividends, cash or stock, and they affect your retained earnings.

Cash dividends mean you’re paying out money, which shows up as a reduction in your company’s assets on the balance sheet. It’s like taking money out of your pocket.

Stock dividends don’t involve handing over cash. Instead, they’re a bit like reshuffling your cards. For example, if you give one share as a dividend to each shareholder, it’s like cutting the pie into more slices – each slice gets smaller, but everyone still gets a piece.

This doesn’t change the total size of the pie, just how many slices there are. So, while the number of shares goes up, the value per share goes down, but it doesn’t mess with your balance sheet’s size. It just tweaks the value per slice.

Let us help you understand how you can calculate the impact of both cash and stock dividends.

How to calculate the effect of a cash dividend on retained earnings

You can use the following formula to calculate the impact of cash dividends on your retained earnings:

Retained earnings before dividends – cash dividends = retained earnings after cash dividends

- Find the retained earnings on your company’s balance sheet

- Check cash dividend information on your financial statements

- Now subtract the amount of cash dividend from your company’s existing retained earnings

Example: Let’s say you’ve got $100K in total retained earnings, and you want to give each of your four shareholders $10K. So, you hand out $40K in total. To figure out what’s left, you just subtract $40K from your $100K, which leaves you with $60K.

That’s what’s left in your piggy bank after you’ve paid the dividends. So, on your balance sheet, it will show that you’ve got $40K less than before.

How to calculate the effect of a stock dividend on retained earnings

Stock dividends won’t change how much your company is worth overall, but they will affect who owns what.

To understand the impact of a stock dividend, ask yourself:

- How many shares are there? This shows how ownership is spread out.

- What’s the value of each new share? This tells you how much each share is worth.

Once you have those answers, here’s what you do:

- Multiply the value of each new share by the total number of new shares to find their total value.

- Then, subtract this amount from your company’s retained earnings.

Basically, giving a stock dividend means sharing some of the profit with shareholders and giving them more ownership. It doesn’t boost your company’s savings but makes shareholders happy.

How net income impacts retained earnings

Changes, whether good or bad, can really shake up your company’s retained earnings. If you make a profit, your balance sheet will look healthier, but if you take a hit, your earnings will take a dip.

Factors like sales revenue, expenses, and stocks play a big role in whether net income boosts or decreases retained earnings.

Are retained earnings a part of equity?

Retained earnings are a part of equity, so you’ll find them listed under Shareholder’s Equity on the balance sheet. While they’re not exactly assets themselves, they can be used to buy assets like equipment, inventory, or stocks.

So, the more retained earnings you have, the easier it is for your company to reinvest.

Retained earnings and shareholders’ equity

Ever wondered how much your business is worth if you decide to cash out?

Well, to figure that out, take a peek at the shareholder’s equity section in your company’s balance sheet. This section shows your company’s total net worth by listing all the items that make up its value – assets and liabilities included.

Shareholders’ Equity = Total Assets − Total Liabilities

Here’s where things get tricky: some folks think that retained earnings tell you everything about your company’s value. But that’s not quite right. Retained earnings are just one part of your assets.

This information proves useful when you’re thinking about selling your business, attracting investors, or forming partnerships.

Struggling to keep track?

Keeping track of your retained earnings and the value of your total assets can be challenging when you’re a small business owner.

But should that hold you back from growing your business and attracting investors? We don’t believe so!

If you’re struggling to keep track of the value of your assets over time, CoCountant has your back. Our accounting services make it easy for you to stay on top of your tangible assets, ensuring they’re always up-to-date and accounted for.

Let us handle the numbers so you can focus on taking your small or growing business to new heights!

Significance of retained earnings in attracting venture capital

Retained earnings prove significant for your business when it comes to attracting potential investors or clients, as this financial number paints the best picture of your business’s success.

And here’s a little secret: it’s not your net income that’ll seal the deal.

Why? Because net income can be up and down, like a rollercoaster ride. But your retained earnings? They show your commitment as a business owner, your ability to keep your business going, save up, and make money since day one.

To put it simply, they prove you’re in it for the long haul, and that’s what investors love to see.

What are the limitations of retained earnings?

Although retained earnings paint the best picture of your business’s success, relying on just one number can limit your analysis.

Relying on just one number to measure your growth can be tricky

You’d probably want to dig deeper into the trends behind that number to see what’s driving your business forward and how you can make it even better.

Investors aren’t only interested in knowing your total retained earnings

They’re interested in what those earnings are doing – like how much they’re making in returns and whether dividends are being paid out.

The bottom line

Understanding retained earnings is key to grasping your business’s financial health and potential for growth, and you don’t need to work for a giant corporation to understand your business’s retained earnings.

What you do need, though, is the right information at your fingertips: beginning retained earnings, profits or losses for the period, and dividends paid. While that may seem like a lot to track in your accounting cycle, it’s manageable (and affordable!) with CoCountant by your side.

Our GAAP-compliant accounting services ensure you have up-to-date financial insights. This provides a clear view of your income statements and balance sheets, helping you identify and address cash flow issues before they become problems and allowing you to make informed decisions to grow your business.

FAQs

Is retained earnings a debit or credit?

Retained earnings are your credited balance. It increases every time your company earns a profit, making a credit entry. It will also decrease should you distribute dividends or incur a loss, leading to a debit entry.

Is retained earnings an asset?

You can use retained earnings to buy an asset, but retained earnings on their own are not assets.

How to figure out retained earnings?

To find out your company’s retained earnings, you can use this formula: dividends + net income (-net loss) = retained earnings